大而美法案對少數族裔經濟發展的影響

The Impact Of The “One Big Beautiful Act" On Minority Economic Development

In 2025, the U.S. Congress passed the much-discussed One Big Beautiful Bill—a sweeping, ambitious piece of legislation aimed at overhauling key aspects of the economy, taxation, and community development. For minority communities across the country—Asian American, African American, Latino, Native American—this legislation represents not just a shift in policy, but a moment of both opportunity and uncertainty.

One of the most notable features of the bill is its strong investment in affordable housing and community revitalization. By expanding the Low-Income Housing Tax Credit (LIHTC) and encouraging investment in Opportunity Zones, the federal government plans to create over 500,000 affordable housing units over the next decade. These measures specifically target underserved rural and tribal areas, but many urban immigrant enclaves—long burdened by rising rents and gentrification—stand to benefit as well.

Equally significant is the bill’s permanent extension of the Section 199A small business tax deduction, increasing the deduction rate to 23%. This is particularly meaningful for the thousands of small, family-run businesses operated by minority entrepreneurs—restaurants, laundromats, clinics, local newspapers—many of which struggled to survive the economic shocks of the pandemic and inflation. Now, they may finally have the breathing room and capital to recover and reinvest.

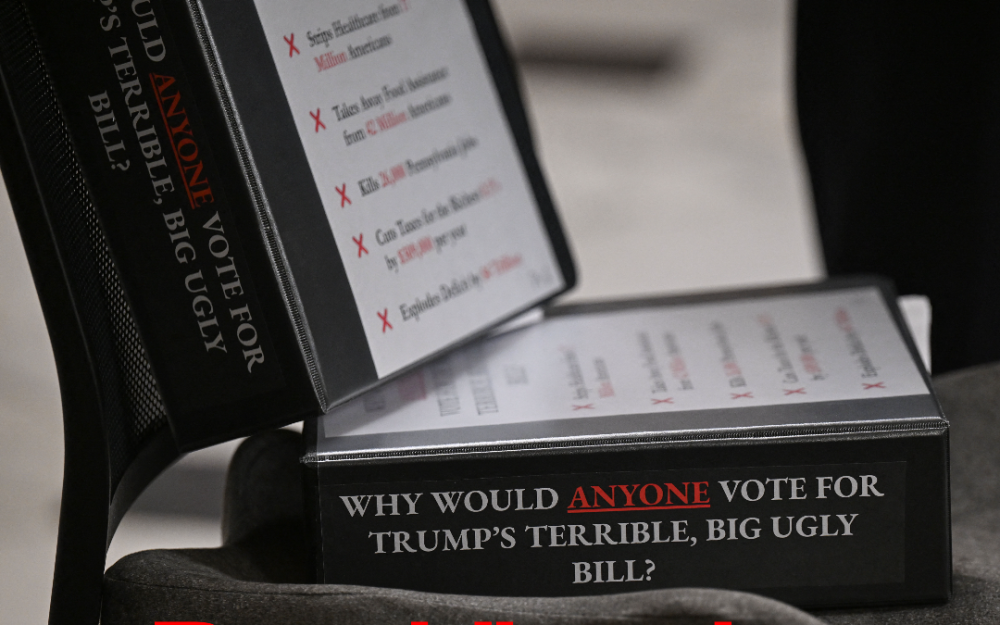

However, these gains come at a high cost. To fund these provisions, the bill makes deep cuts to the social safety net. Medicaid and SNAP (food assistance) are among the hardest hit, with projections showing that millions could lose access to healthcare and food support. These reductions disproportionately affect low-income families of color, many of whom still rely on public assistance to meet basic needs.

Thus, we must view the Big and Beautiful Act with cautious optimism. It indeed opens new doors in housing, entrepreneurship, and community development for minority populations. But if prosperity is built on a weakened safety net, the long-term risks could outweigh the short-term gains, deepening inequality and social division.

The challenge now is ours. Can our communities mobilize to ensure that these federal resources reach the grassroots? Are our local organizations and small businesses ready to seize this moment of revitalization? Will our voices be heard by the policymakers shaping our future?

This is a test of resilience, vision, and unity. And it’s up to us to rise to the occasion—with action and not just hope.